Hydrogen is regularly touted as the fuel of the future and there are many good reasons why this is the case, though some significant challenges must be addressed before it can realise its potential.

It is one of the central pillars of the Australian government’s net zero emissions modelling, a key focus of the various state governments eager to carve out a slice of the pie and has found itself an evangelist in none other than FMG founder Andrew Forrest.

The European Union plans to have at least 40 gigawatts of its own green hydrogen production by 2030 and could potentially import another 40GW to meet its 2050 net zero deadline.

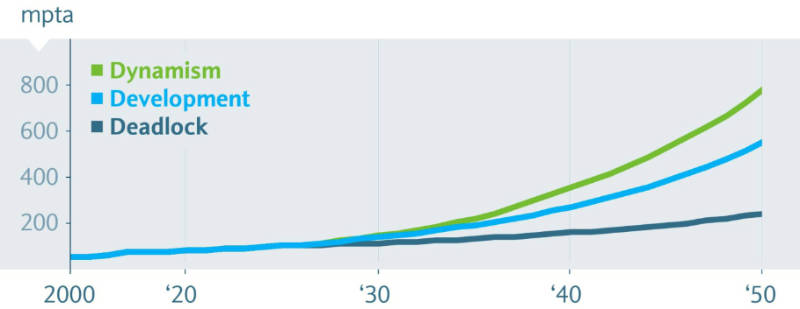

Meanwhile, Barclays Bank has forecast that 696 million metric tonnes of hydrogen could be used by 2050, a six-fold increase on current levels.

So just why is the lightest element seen as the next best thing since sliced bread?

For starters, hydrogen is a rich source of energy that can be outright burnt or combined with oxygen in a chemical reaction that generates electricity and heat (ie fuel cells).

Either way, the only byproduct of this process is good old dihydrogen monoxide, or water.

In other words, when used as an energy source, hydrogen has none of the nasty emissions produced by other energy sources.

Hydrogen is also a strong reducing agent, meaning that it can be used in a range of industrial process including as a replacement for coking coal in steel production – a point that Forrest is keen to highlight – and is also used in the fertiliser and petroleum sectors.

It is also incredibly abundant with multiple methods of production that have varying pros and cons.

Hydrogen production

Here’s where we delve into the first major decision point facing the sector and, in some sense, the most fundamental. How do we actually get our hydrogen?

While others have broken down the different methods into a dazzling array of coloured coded types, they can really be divided into two categories, hydrogen produced from fossil fuels with resulting carbon emissions captured and either sequestered or used (blue hydrogen), and hydrogen produced from water using electrolysers powered by renewable energy (green hydrogen).

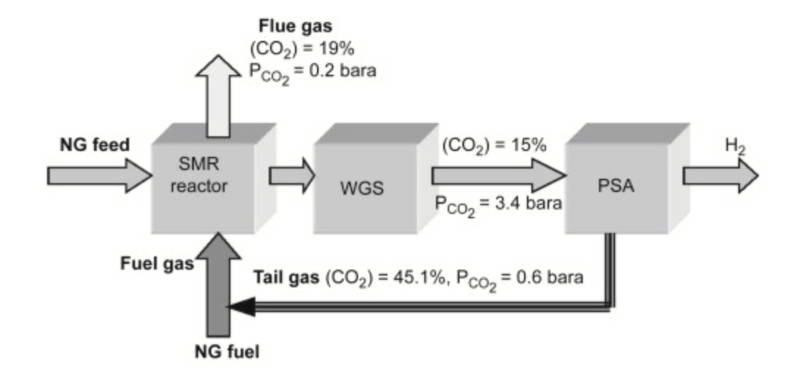

Hydrogen produced from natural gas using steam methane reformation, which entails the separation of hydrogen atoms in methane from carbon atoms, has been with us for about 100 years; there’s quite simply nothing new about it.

It does however produce greenhouse gases such as carbon dioxide and carbon monoxide.

Pilot Energy chairman Brad Lingo told Stockhead that most of hydrogen that is currently produced in the world is the result of steam methane reformation with some form of carbon capture and storage already associated with some plants since the 1980s.

And its maturity is telling with numbers run by S&P Global Platts and International Energy Agency showing that grey hydrogen (which comes without carbon capture) is being produced at US$1 per kilogram, blue hydrogen at US$1.42/kg to US$1.50/kg, and green hydrogen in excess of US$4/kg.

“Over the last 100 years, they figured out all the ways to optimise it and make it more efficient in terms of using natural gas as a feedstock and just about every fertiliser plant and refinery in the world is a hydrogen plant at its heart,” Lingo explained.

“It is a very proven and mature technology whereas it is a proven process to produce hydrogen from water and electricity but there’s a lot to be done in bringing down the cost of electrolysers, making them more efficient.”

This efficiency and low cost is exactly why blue hydrogen proponents say it is the right technology to build the hydrogen sector up to the level where it is sustainable and green hydrogen is mature enough to take over.

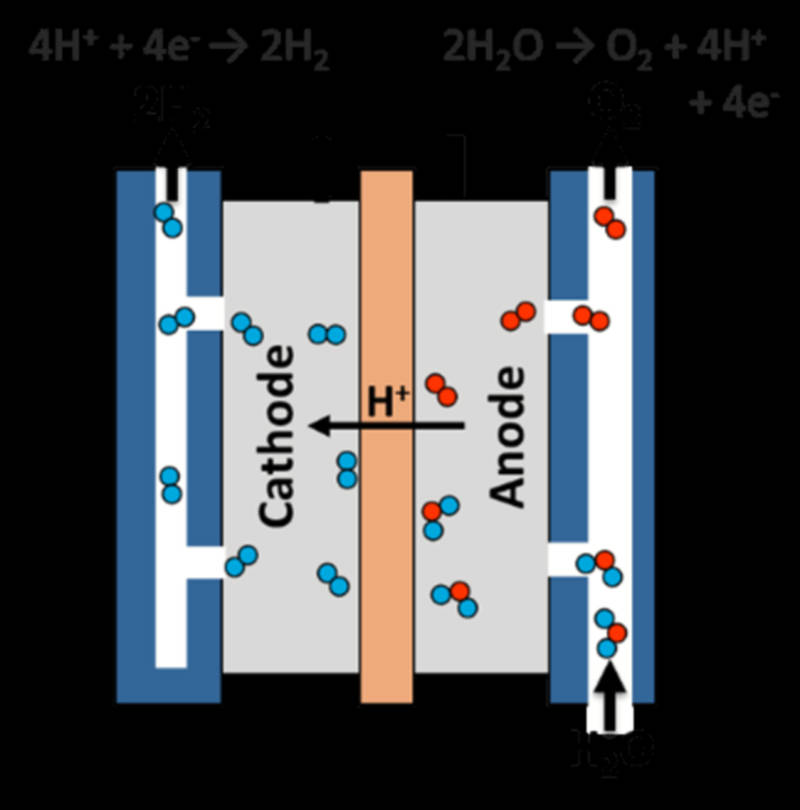

On the other side of the coin, the technology to produce green hydrogen using electrolysers powered by renewable energy to break down water into oxygen isn’t exactly new either.

What’s new is scaling up the technology to the levels required to fuel the hydrogen economy and reaching the efficiencies and pricing enjoyed by its competitor.

Monash University Department of Civil Engineering senior lecturer Dr Stuart Walsh told Stockhead that the price of electrolysis and renewable energy powering the process had fallen considerably and much sharper than anyone had been expecting it to.

“This means the transition to green hydrogen is occurring a lot faster than we think,” he noted.

Dr Walsh highlighted Chile’s goal of having the world’s cheapest green hydrogen by 2025 as an example.

The South American country has flagged that green hydrogen could cost it just US$1.30/kg by that time and has also made clear its ambitions to be one of the world’s largest exporters of green hydrogen by 2040.

“That is just around the corner. These sorts of shifts, when the occur, they occur fast and I don’t know if it will be driven by policy or financial changes,” Dr Walsh said.

He added that changes in the energy industry can happen really quickly, pointing to the quick shift from coal to natural gas in the US.

“The cheap price of natural gas in the US over the last few years has meant that they haven’t put any new coal-fired plants online since 2014 or so.

“If the economics are right, the transition can be really fast. People will go for the cheaper way to produce energy.

“That will ultimately be the driver for widespread adoption of many of these technologies.”

Dr Walsh also noted that while green hydrogen or its related products such as green steel might be a little more expensive, people may also be willing to pay a premium in order to receive the kudos for having a green product.

Adoption challenges

Widespread adoption of hydrogen is certainly on the cards but there are a number of challenges that have to be addressed before we get to that point.

Production of hydrogen at a price point competitive with or better than fossil fuels is just the start, but in many ways it is just a matter of scaling up and figuring out how to improve efficiencies.

The gas and its high flammability, high diffusivity and low density as well as its potential to weaken metal or polyethylene pipes all require answers.

Hydrogen’s volatility means that sensors need to be installed to detect leaks while its low density and ultra-low temperatures needed to keep it liquid means long-distance transportation is less efficient than with liquefied natural gas.

Hydrogen also causes embrittlement – or a loss of ductility of a material that makes it brittle – meaning that transport using existing metal or polyethylene pipes at high pressures could cause leaks.

Dr Walsh acknowledges that there are certainly some technical challenges.

“Long distance transportation of hydrogen is one where we are still thinking about some of the hurdles that we need to overcome for that,” he noted.

“However, having said that, a lot of the challenges are just about scaling up at this stage.

“We know how to produce hydrogen, we know how to store hydrogen, we know how to transport hydrogen.

“It is about going from where we are at now and where we will be in the future.”

Dr Walsh noted that some options for long distance transportation include converting the gas into ammonia, which is easily liquefied, compressing hydrogen and liquid hydrogen.

“I know the CSIRO has done a lot of great work in that area about transporting hydrogen as ammonia.”

He added that there is a big benefit in the short term from the mixing of hydrogen in with natural gas and moving it through existing pipelines for the domestic market.

“My understanding is without too much of a headache, we can get maybe 10% of our gas switched over to hydrogen today and people are already looking at how to switch over to 20%,” he noted.

“It won’t happen overnight, but it is definitely something that serious people are looking at and it seems to be possible.”

Investing in ASX hydrogen stocks

Here are some ASX small cap companies with exposure to hydrogen.

ADX Energy (ASX:ADX) is proposing to use its depleted natural gas reservoirs in Austria’s Vienna Basin for the underground storage of green hydrogen produced using excess renewable energy.

Each reservoir could potentially store about 500 times more energy than the largest Tesla energy storage Mega Pack (about 200MWh), or enough power for 20,000 households over one year, at a much lower price.

Environmental Clean Technologies (ASX: ECT) is focusing on the development of a net zero emission hydrogen refinery in Victoria’s Latrobe Valley using its Coldry technology.

This tech provides low-cost, zero-emission dewatering and drying of incoming lignite and biomass streams, which will then be fed into a thermochemical decarbonisation process to produce a hydrogen-rich synthesis gas and a char product containing most of the carbon in solid form.

The hydrogen-rich syngas is then utilised by integrated downstream applications within the project to produce hydrogen, formic acid and generate electricity

Eden Innovations (ASX: EDE) is another tech play that is promoting its patented methane pyrolysis technology that produces hydrogen from a hydrocarbon feedstock such as natural gas while spitting out the carbon as carbon nanotubes that are potentially more valuable than the hydrogen.

The company is currently reviewing several possible new applications and markets for its carbon nanotubes beyond its current EdenCrete concrete additive and its EdenPlast carbon nanotube enhanced plastics and polymers.

Global Energy Ventures (ASX: GEV) has developed a compressed hydrogen shipping solution that is says will provide the safe, energy efficient and cost competitive transport of hydrogen.

It has already received approval in principle from the American Bureau of Shipping for a pilot-scale Handymax-sized gas carrier, which is relatively small and able to enter most ports.

The company is also developing its Tiwi green hydrogen project in the Northern Territory that when combined with its proposed carriers, will deliver a fully integrated green hydrogen production and export supply chain.

Hazer Group’s (ASX: HZR) patented process was first discovered in 2010 and combines methane and unprocessed iron oxide to create hydrogen and a solid graphitic carbon.

As of November 2021, the company is constructing a commercial demonstration project at the Western Australia Water Corporation’s Woodman Point Water Recovery Facility.

This will take biogas (methane) captured from sewage waste received at the plant for conversion into the green gas.

Hexagon Energy Materials (ASX: HXG) is progressing its Perdika blue hydrogen project that will source coal from its existing tenements as feedstock through a pre-feasibility study.

The coal will undergo gasification to produce hydrogen for export or domestic markets while the carbon dioxide emissions will be captured and sequestered underground or used for enhanced oil recovery projects.

Lion Energy (ASX: LIO) is evaluating the potential for building a network of modular green hydrogen production and refuelling stations across Australia.

This will focus on infrastructure attached to the national energy market for the domestic heavy mobility market.

Originally a coal play, Montem Resources (ASX: MR1) has turned around and revamped its Tent Mountain project into a renewable energy project integrating wind and pumped hydro to produce green hydrogen.

This is proposed to combine a 100 megawatt wind farm with 320MW of pumped hydro energy storage and a 100MW green hydrogen electrolyser to provide the Canadian state of Alberta with power grid stability as it phases out coal.

Pilot Energy (ASX: PGY) recently formed a consortium – including gas infrastructure major APA Group (ASX:APA) – to jointly undertake and fund the feasibility study for the Mid West Blue Hydrogen and Carbon Capture and Storage project.

The feasibility study will focus on blue hydrogen technology, regional CCS potential, hydrogen markets, project infrastructure and commercialisation.

It will also carry out a standalone assessment of the Cliff Head project’s CCS potential.

Pure Hydrogen Corporation (ASX: PH2) has several irons in the fire including an agreement with CAC-H2 to build three wood waste-to-hydrogen plants on the east coast of Australia and a strategic stake in fuel cell pioneer H2X Global.

The company also plans to use pyrolysis process to convert methane from its Serowe coal seam gas project in Botswana and the Venus CSG project in Queensland into blue hydrogen.

Province Resources (ASX: PRL) is developing the HyEnergy green hydrogen project in Western Australia’s Gascoyne region.

This will be supported by up to 8 gigawatts of renewable energy.

It is also working with Global Energy Ventures on a feasibility study into the use of compressed hydrogen as the preferred export carrier for HyEnergy gas.

While primarily a vanadium-focused explorer, QEM Limited (ASX: QEM) is also studying the potential for “green hydrogen opportunities” at its Julia Creek vanadium and oil shale project in Queensland.

This will be applied directly to its vanadium and oil production with the excess earmarked for a potential hydrogen hub in the North West Minerals Province.

Sparc Technologies (ASX: SPN) is working with the University of Adelaide to progress an Australian made “ultra green hydrogen” technology that does not require electrolysis to extract the gas from water.

Without the cost of energy required to power the electrolysers, the project partners are targeting a commercial scale technology to help meet the $2/kg target widely regarded as the point where green hydrogen is cost competitive with fossil fuels.

SRJ Technologies (ASX: SRJ) is progressing its hydrogen compatible pipe technology that seeks to address issues with transporting the gas through pipelines.

The company is currently carrying out a detailed analysis of the future market, the demand for leak sealing, mechanical connectors, isolation, repair and integrity solutions that can deal with the complexities of handling hydrogen.

TNG Limited (ASX: TNG) has formed a joint venture with Malaysia’s AGV Energy to progress a green hydrogen project in Darwin.

This could be expanded to other sites in Australia.