Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Caltex Australia share price has climbed 35% in five years, easily topping the market return of 5.8% (ignoring dividends).

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

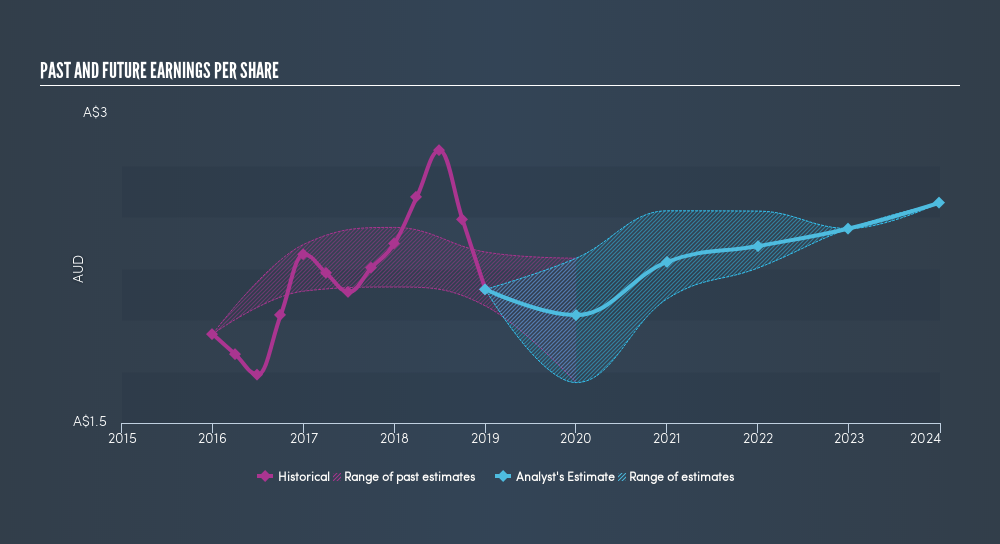

During five years of share price growth, Caltex Australia achieved compound earnings per share (EPS) growth of 1.8% per year. This EPS growth is lower than the 6.2% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That’s not necessarily surprising considering the five-year track record of earnings growth.

The company’s earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Caltex Australia’s earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Caltex Australia’s TSR for the last 5 years was 56%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Caltex Australia shareholders are down 15% for the year (even including dividends), but the market itself is up 7.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn’t be so upset, since they would have made 9.3%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. The data on insider buying is an obvious place to start. You can click here to see who has been buying shares – and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Extracted from Simplywall