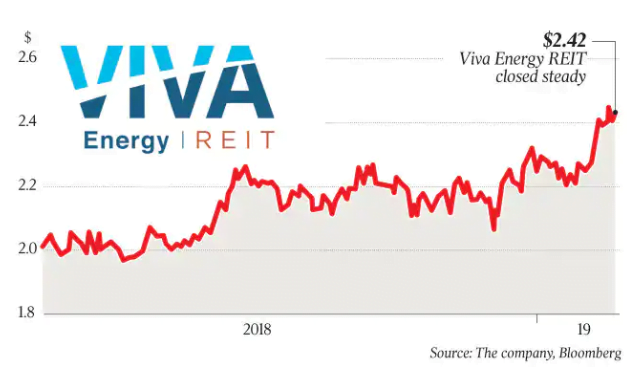

Viva Energy REIT has extended the run of real estate investment trust raisings this year as it looks to expand its $2.5 billion empire of petrol stations and convenience stores.

The trust, with financial adviser Evans Dixon at its side, tapped the market for $100 million worth of equity in a raising handled by JPMorgan and Deutsche Bank.

The offer was priced at $2.32 per new security and will be used to pay for acquisitions of petrol stations. The fact that Bank of America Merrill Lynch was not on the advisory ticket was quickly noticed by the intensively competitive equity capital market sector.

BAML had been involved in floating the Viva Energy REIT in 2016 and then Viva Energy last year but was not a part of this transaction.

BAML’s former head of ECM, Karla Wynne, is now the head of investor relations and strategy at Viva Energy, which owns about 38 per cent of the listed REIT.

A BAML spokeswoman did not respond to DataRoom last night. The appointment of JPMorgan to the deal was a win for the firm, while Deutsche Bank has worked on a number of Viva transactions in the past.

The trust also wanted to replenish after previous acquisitions but some of the proceeds will partly back the purchase of eight service stations for about $47m, taking its holdings to 454 nationally.

The properties carry very long leases and play into the popular convenience retail theme investors are flocking to as they steer clear of department stores and fashion.

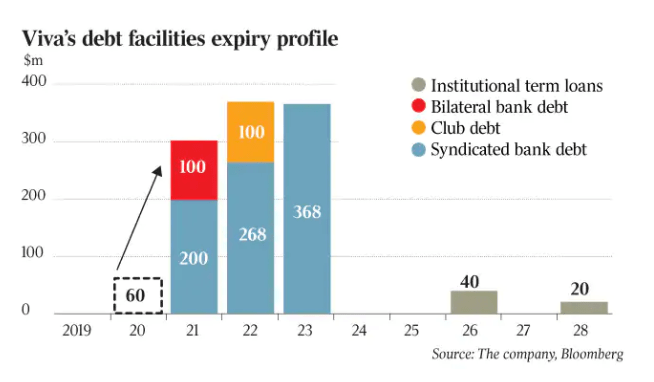

The fund also trimmed back its target gearing range to 30-45 per cent and the raising will help support its expansion as another $130m worth of potential acquisitions are on the cards.

Distributions will hit the top end of guidance and the fund is forecasting a bullish 4.5 per cent growth in distributable earnings per security. The listed property sector has been a hotbed of raisings in an otherwise quiet market as investors chase out stocks with defensive qualities and steady earnings growth.

While residential developers and retail landlords are a no-go zone, trusts that sport dependable income are winning investment — and nimble players are capitalising.

Paul Lederer, billionaire and co-owner of A-League club Western Sydney Wanderers, this week turned a quick profit by selling his 5.15 per cent stake in the Charter Hall Long WALE REIT. That $65m interest was snapped up by institutional investors garnered by UBS. The Abu Dhabi Investment Council last month sold a $400m stake in Goodman Group, also via UBS.

Even more raisings had been tipped ahead of results season, and Aventus and National Storage are on many watch lists, but groups that come to market are expected to have assets lined up or a good story to sell.

Investors like the Viva trust’s growth strategy and it has added Caltex, 7-Eleven and Liberty Oil properties to its portfolio, which is underpinned by Viva Energy Australia. The fund’s raising was well-timed after a run-up by the passive trusts and also will allow new institutions to get on to the register as the free float will increase because Viva Group will not participate.

Extracted from The Australian